Member renewal instructions

Renewals are now open. Here you can find instructions on the member renewal process.

Benefits of membership

- Use of designatory letters and IFA logos to use on your stationery and website.

- Dual membership of the Institute of Public Accountants (IPA) of Australia.

- Free printed members' magazine, Financial Accountant six times a year delivered direct to your door.

- A weekly e-newsletter drawing together the latest news, articles and opinion from Financial Accountant digital our online content platform.

- Exclusive offers from our carefully chosen partners.

- Technical resources which cover AML and include a suite of example engagement and disengagement letters.

- Regional networking events offering the opportunity to connect with like-minded peers.

- A range of relevant CPD workshops and webinars featuring expert speakers industry.

Member renewal instructions

Renewing your membership has never been easier. Below provides clear instructions on how to renew your membership by the deadline of 31 December 2023, and what could happen if you do not.

If you are having any problems renewing, please contact the membership department as soon as possible to avoid late fees, lapsing or disciplinary action being taken against you.

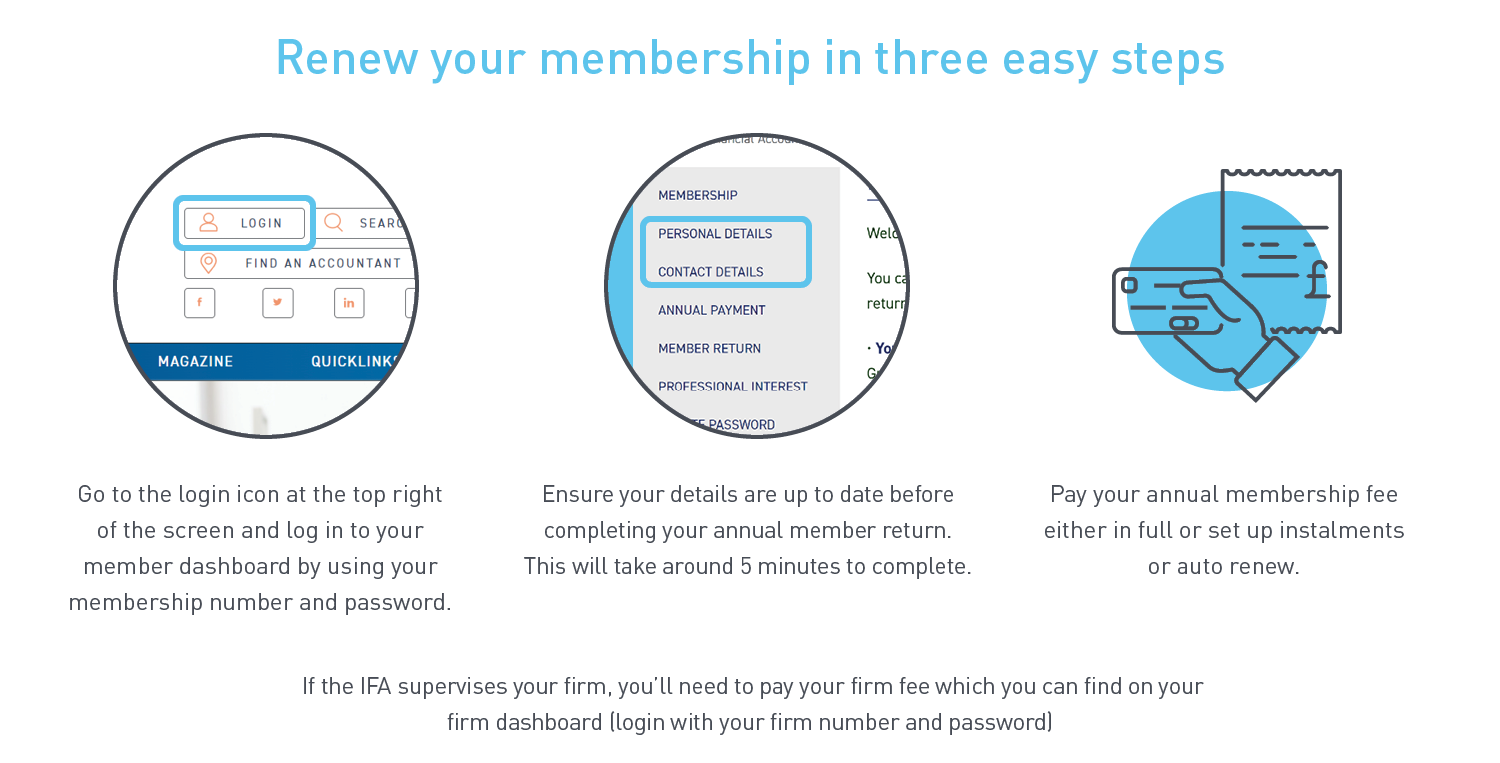

How to renew your membership

Logging into your Member dashboard

To complete your mandatory annual membership renewal, first login to your member dashboard using your member number and password.

Whilst you can still log in using your member email, this, method will not guarantee access to the correct dashboard. Using your member number is recommended as it ensures sign on to your member dashboard.

Forgotten password

Recover your password by selecting the forgotten pasword link and entering your member number as your username into the field.

Paying your annual Membership fee

You can pay your mandatory annual membership fee with a credit or debit card on the Annual Payment tab of your member dashboard.

Alternatively, you can choose to set up auto renew payments or instalments by selecting your preferred payment method before you pay.

Auto renew payment option: This method automatically takes payment from your credit or debit card in the first week of January every year.

Instalments payment option: This method splits your fee into three payments: the first is taken when it is set up, the second payment will be taken on 4 January 2024, and the third payment on 1 Feburary 2024. You can set this up by either contacting the Membership team on +44 (0)20 3567 5999 or via the Member dashboard's annual payment tab and selecting the instalment plan option. The deadline for setting up instalments was 15 December 2023.

You can also pay by direct debit, bank transfer, cheque or on the phone. See our payment methods page for full details and instructions on all options and set up.

Submitting your Annual Member Return

Review your details and complete your Member Return

We advise that you check the details we hold on file before completing your return as you will be asked to confirm if the information is correct during your member return.

Throughout the process, you can save your progress by clicking “Quick Save” or “Save and Exit” from the buttons found at the top and bottom of each page. Please note that these options do not submit your firm return, they just save your progress.

1. Review your details by clicking on the Personal Details and Contact Details tabs.

2. Start your member return by clicking on the Member Return tab and go into the portal, to work through each section.

3. Confirm whether you have complied with the IFA’s CPD requirements for the past 12 months. Once answer, press Next Section at the bottom to move onto the next.

4. Finally click the confirmation button to confirm that the information you have provided is correct.

Once you have answered all the questions, click “Submit” to submit your member return. You will receive an on-screen acknowledgement that the declaration has been successfully submitted. You can download/print your member return by clicking the PDF icon on this page.

Please note: If you are based in the UK, you may also be asked a question about whether you are in Public Practice or not. This helps the IFA meets its regulatory and supervisory responsibility.

Failure to submit the annual member return

Late fees

A late fee of £30 is applied to unpaid invoices on 1 February 2024. This fee covers the IFA’s costs incurred for chasing outstanding invoices.

Disciplinary actions

If you have paid your fees but failed to submit your return by the 31 March then you may go before the regulatory case manager in accordance with the IFA bye-laws, which could result in you being penalised with fines or expulsion.

Lapsing Any members or firms with unpaid invoices will lapse after 31 March in accordance with Bye-law 8.5(a). Please ensure you have paid your membership and firm fees before the deadline. Your membership will lapse if either set of fees are unpaid.

Help and Support

Reduced Membership fee You may be eligible for reduced membership fees if you are on a low income. All requests should be made in writing addressed to the Membership Manager. Please note that any reduction granted will be valid for one year only. You need to reapply if a reduction was applied to your fees last year.

Contact us

If you are having difficulties paying your annual firm fee, completing your annual firm return, or accessing your dashboards please contact the compliance team on +44 (0)20 3567 5999 or [email protected].

IFA/IPA Benevolent Fund

The IFA/IPA benevolent fund is a registered Charitable Incorporated Organisation. The charity provides financial support for all IPA Group members and dependents faced with a sudden illness or change in circumstance, such as redundancy. Current members are eligible to become voting members of the charity by making a voluntary contribution to the Benevolent Fund. Voting members can vote at the AGM and attend benevolent fund meetings. To find out more, visit our webpage.